09.10.2020

US-Wahlen: Welche Risiken sind bereits eingepreist?

There is no doubt that a US presidential election represents a risk for financial markets and a good way to quantify how much risk is currently priced-in is to look at the forward implied volatility before and after the elections.

For that, the VIX index, a basket of the S&P 500 options volatility, sounds a good barometer.

Looking at the VIX curve, The November expiry is currently trading 1.5% above the December one, reflecting the immediate risk investors are facing post-election (November 3rd) relative to December.

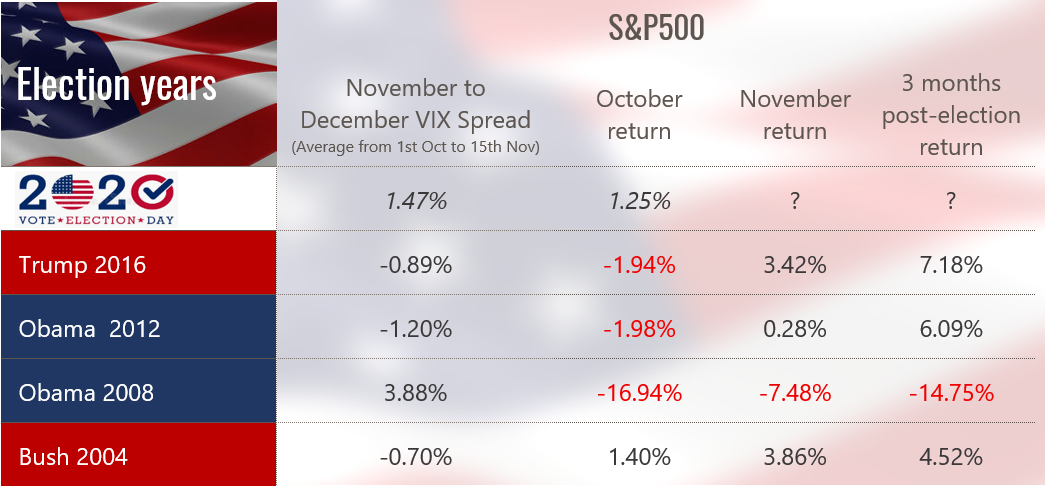

While the 1.5% spread indicates a higher implied risk around and after the election, it does not quantify the absolute level of risk. To put it in perspective, we looked at the average November-December VIX Spread from October 1st to November 15th for every US Election since 2004.

Excluding the US election during the Great Financial Crisis in 2008 where spot volatility was structurally higher than 1, 2 and 3 months forward, it appears that a positive November/December VIX Spread is somewhat unusual. In fact, during the 2004, 2012 and 2016 elections, the November VIX never traded above the December one.

Looking at the return of the S&P in October, November and 3 months after the election, we can observe that it is very difficult to draw any conclusion over a US presidential election from a financial market perspective. If anything and excluding the 2008 election during the crisis, the simple and most direct conclusion would be that a US presidential election after 2000 had a positive impact on the S&P 500 Index one month and 3 months after the outcome.

So how to explain this extra-risk this time? We believe the 1.5% premium in November volatility relative to December likely reflects one single risk: if Biden wins, President Trump might not going to accept it. A sentiment that has been reinforced after the first TV debate of the US elections.

To conclude, history shows that financial markets can easily deal with a republican or democrat president but definitely not with no President after November 4th.

Mehr Publikationen

30.06.2025

ESG und KI: Ausweitung des Stewardship-Modells auf den französischen Markt

In Zusammenarbeit mit Professor Didier Cossin, der Caisse des Dépôts und Rcube Asset Management freuen wir uns, die Ausweitung des Stewardship-Modells, das den Kern der Philosophie unseres Fonds GBI Good Governance (+20 % gegenüber dem US-Index seit Auflegung) bildet, auf den französischen Aktienmarkt bekannt zu geben.

Pressemitteilung lesen (FR)18.06.2025

Willkommen, John Plassard!

Mit großer Freude und Begeisterung geben wir bekannt, dass John Plassard am 14. Juli als Partner zu Cité Gestion stoßen wird.

Mehr dazu15.05.2025

Harvard x Cité Gestion

Wir hatten das Vergnügen, das Galadinner in Mexiko City zu unterstützen, das zur Feier des 75-jährigen Bestehens des Harvard Gala Dinners veranstaltet wurde. Ein markanter Abend, an dem Alumni aus ganz Mexiko zusammenkamen.

Mehr dazu